The latest Australian property market data from CoreLogic is in.

It reveals that the Australian property market is experiencing a continued upward trend, signalling a generally positive outlook for the future.

But as property values rise, particularly on Queensland’s Sunshine Coast and Hervey Bay Region, so too are investors’ emotions, leading to misinformed and impatient purchasing decisions.

Our goal is to protect you from making this same mistake

So, we’ve put together a guide to making informed property decisions that are based on both numerical and boots-on-the-ground observational data.

Read on to find out how you can navigate this tricky market with ease and secure sustainable investment success long into the future.

The current Australian Market Outlook: April 2024

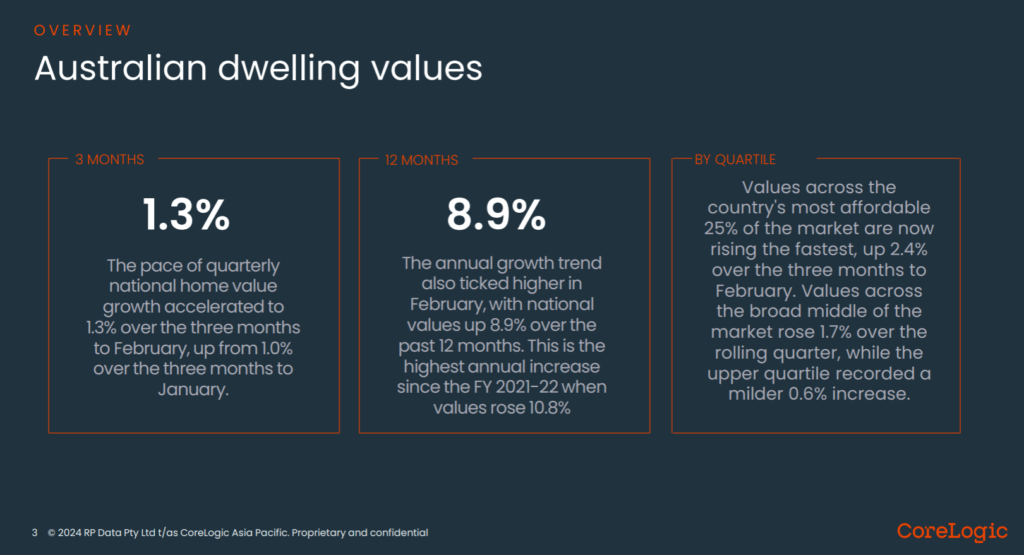

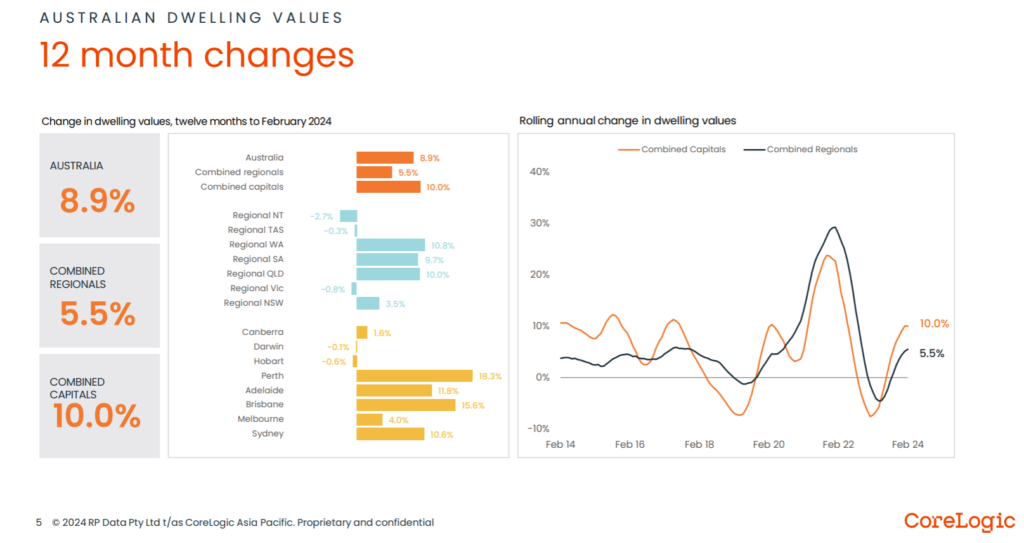

According to CoreLogic’s March 2024 report, over the past year, the nation has witnessed a substantial 8.9% increase in dwelling values, marking the highest annual rise since FY 2021-22.

As for the nation’s capital cities, the story remains much the same:

- Though not at its 2022 peak, the Sydney market continues to climb with a 0.5% monthly increase on top of its already significant 10.6% annual growth.

- The Melbourne market witnessed a more modest 0.1% uptick on top of the 4.0% annual increase, likely driven by increased property taxes which have spooked many investors.

- A shining light in the Australian market with a 0.9% monthly increase, Brisbane continued to shine with a remarkable 15.6% annual growth and all-time high property values.

- Adelaide’s and Perth’s markets are also flourishing, with a 1.1% and 1.8% monthly increase and an 11.8% and 18.3% annual increase in dwelling values, respectively.

- Meanwhile, property values in Hobart and Darwin have fallen by 0.6% and 0.1% annually and Canberra has posted a modest 1.6% uptick in that same time.

Overall, most major cities are experiencing growth in market value, and despite some cities facing minor setbacks, the combined positive momentum suggests a healthy and promising Australian real estate market.

What we’re seeing ourselves in-person

While understanding the market from a statistical point of view is crucial, the best property investors also take into account first-hand observational data.

With boots on the ground in the Brisbane, Sunshine Coast and Hervey Bay property markets every day, our team are seeing a lot of important trends that current and aspiring property investors should be aware of.

Most notably, we’re noticing significantly limited housing stock

While dwellings with price tags in the mid $2 million range and above are taking a long time to sell, dwellings with a sub $1 million price tag are practically flying off the market leading to a lack of housing supply.

In fact, this observation is confirmed by CoreLogic who found that the median time on the market for Brisbane property so far in 2024 is just 23 days, even lower than the average of 29 days in 2023.

As is to be expected, vendor discounting is likewise low and Brisbane currently has the second lowest Vendor Discount Rate, meaning buyers are only able to discount 3.3% from the asking price on average.

Another major trend that can only be gathered by our boots on the ground is the soaring anxiety and frustration of buyers – particularly in the South East Queensland property market.

With a combination of:

- low stock,

- soaring competition,

- very little time to sell, and

- record high house prices,

many Queensland property buyers are missing out on properties and they are quickly becoming frustrated and impatient – and who can blame them?

The problem is that these buyers, when driven by their emotions often rush to put in offers when they shouldn’t, to make the pain go away. From afar, we’ve seen countless purchasers who have made an impatient, emotionally charged decision only to suffer from significant buyer remorse later down the line.

The good news is, that savvy purchasers are starting to wake up and take the action they know they need to take…

Why You Need a Buyer Agent in Queensland’s Boom Market

As we’ve just discussed, it’s a highly competitive market for buyers in Queensland and emotions are running high.

In fact, we estimate that approximately 30% of property contracts are falling through in South East Queensland because buyers simply don’t have their ducks in a row.

As a result, more and more Queensland property buyers are making decisions based on emotion and trying to put their frustration to rest, leading to purchases without the right market research, legal or financial backing.

Fortunately, there is a way Queensland Property Buyers can both speed up the purchasing process and make informed decisions at the same time – and that is with a Trusted Buyers Agent like our team at Worth Property Investing.

We have the data, the industry network, the market knowledge and the legal support to secure your next property purchase, faster and at the best possible price. Recently, we’ve even secured property for our clients at a lower price than other competitor offers because the agent knew that with Worth Property involved, the sale was sure to be a smooth and professional process.

So, are you ready to secure the property investment of your dreams?

Worth Property Investing can help you buy the right Queensland investment property in 2024

My team and I are passionate about helping you make the right investments to achieve your financial goals and lifestyle aspirations.

Think of us as your property-buying partner, here to support you in making the ideal property decisions and making the most of Queensland’s booming property market. As your trusted, licensed Buyer’s Agents, we do everything from searching, connecting, researching, bidding, negotiating and securing the best investment for you.